3 Best Invoice Apps to Keep Your Cash Flow Smooth

Every newspaper printing and magazine printing business has the same goals: to grow distribution, increase advertising revenue, and drive sales. The best invoice apps can help keep track of your finances as you work toward ultimate success.

When it comes to generating higher revenue, businesses greatly consider marketing efforts, sales strategies, and day-to-day business operations. But one aspect of financial success often overlooked is invoicing. Invoices are the tool that drives payment; even then, 54% of businesses expect late payment of invoices. This causes cash flow problems that can be a detriment to your company. Streamline the process with automated invoice apps that manage and coordinate the receipt of your payments.

Keep reading to learn about the benefits of automated invoicing and identify the three best invoice apps to get you paid easily and on time.

Key Takeaways

- Invoicing helps you maintain control of taxes, purchases and payments, and business decisions.

- From quicker payments to improved data management, invoice apps benefit your publication, readers, and advertisers.

- While countless invoice automation systems are available, we feel the three best invoice apps are QuickBooks Online Mobile App, Invoicely, and Wave.

Why Is Invoicing Important?

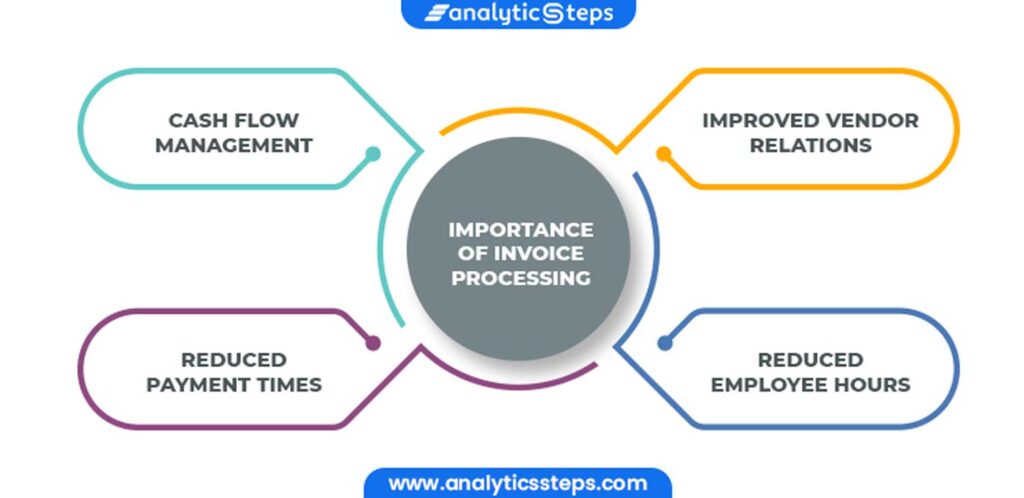

Invoicing is one of the most important aspects of your business transactions. For companies in B2B markets, invoices are mandatory for sales. They help keep track of income and sales records and enable you to declare income for tax purposes. Invoices also help with cash flow management, reduce payment times, improve vendor relations, and save time.

Ultimately, invoices grant you overall control of three main areas of your business.

1. Maintain Tax Control

Invoices help you gain a realistic expectation of how much tax you’ll pay each year. With accounting features like the sales tax report (which highlights the tax you accumulated from sales and input tax from purchases), you can gain an overview of your tax information and will know how much you’ll owe or how much you’ll receive. Tracking these details throughout the tax reporting period is essential to avoiding an unexpected, huge tax bill that can affect your cash flow.

2. Control Cash Flow

Invoicing helps you maintain control over your incoming and outgoing bills. Keep tabs on which invoices you’ve paid and which ones are outstanding. Overdue payments require follow-up to ensure you receive the money you’re expecting. Without regimented tracking, it’s easy to overlook which of your contacts have paid and which ones still owe you money.

3. Manage Your Decisions

Your invoices are a valuable record of current and past projects and their impact on your bottom line. You can review these projects and determine which ones were most profitable and worth pursuing in the future, helping you know how to allot your time and resources. You can also identify projects that aren’t helping you achieve your sales and marketing goals and drop them from your pipeline. This helps increase efficiency and drives success.

3 Best Invoice Apps for Your Business

There are countless options available for effective and impactful invoice apps. While other sites might give you an extensive list of endless possibilities, let’s not overcomplicate things. After all, the whole point of invoice apps is to simplify! That’s why we’re going to list only our top favorite tried and true systems. Based on our research and experience, here are the three best invoice apps for your business.

1. QuickBooks Online Mobile App

QuickBooks Online is well-known accounting software that helps businesses track both income and expenses. With a paid subscription, you can download their app for free and access a wealth of useful invoicing features. You can input transactions, document expenses, invoice customers, and access reports from your mobile device. It also backs up all of your data to the Cloud so that you can access your information at any time, from anywhere.

If you upgrade to the QuickBooks Online Essentials, Plus, and Advanced plans, you can take advantage of more assets like time tracking, journal entries, and credit memos. You can also manage transactions in other currencies with the multicurrency feature, which is helpful if you have international customers.

QuickBooks Online isn’t just easy for you. It provides a smooth transaction experience for your readers and advertisers. They can make payments conveniently and securely with the click of a button. That’s why it has a four-star rating on the Google Play store, where you can find and install it on your device.

2. Invoicely

We like this option for several reasons. First, its app and subscription are free and include up to five monthly invoices. Need more than that? Their basic plan starts at just $9.99. What we like about Invoicely is that it allows you to accept multiple, unconventional payment methods. In addition to typical credit card payments, people can submit money via PayPal and Stripe.

Invoicely offers a variety of invoice templates, so you can find something that works for your business. The user interface is sleek yet intuitive, simple and easy to navigate. You can add your signature if your audience requests that. Invoicely also helps you track expenses, time, and mileage on one dashboard, serving several bookkeeping purposes. If you’re a smaller business that doesn’t need to send many invoices each month, this app could be a great help.

Interested in getting started? The following video is a beginner’s guide to Invoicely and walks you through how to use this impactful tool:

3. Wave

Wave is unusual in that it’s completely free. It doesn’t offer paid plans for invoicing, accounting, and banking services. Regardless, it still provides all the features and benefits of a paid service. Track finances, and create and send invoices in any currency (but note that it doesn’t convert international currencies). While you can’t remove the Wave watermark from the invoice, you can export the invoice as a .pdf and send it as an email — the watermark won’t appear.

Wave’s dashboard is user-friendly, so you don’t need accounting experience to manage your finances. Its reports will give you a complete snapshot of how your business is doing, and its in-house team of coaches can walk you through any questions or issues. When it comes to cyber security, Wave has taken preventative measures to protect its client data. The app monitors facilities 24/7, and credit card information is encrypted and not stored through the app.

Simplify Your Invoicing Processes

BOOM Communications provides advertising and marketing solutions that help drive traffic to your site and increase conversion rates. Whether you want to grow page count or find ways of lowering the cost of doing business, our experts can help you develop effective strategies and unique ideas to grow small newspaper revenue.

Contact BOOM Communications today to learn how we can help you simplify your invoicing for quicker payments and improved financial health.