Weathering the Storm: 3 Small Business Ideas During a Recession

Managing a small business is difficult enough when times are good, but it’s even more challenging when the economy is in a downturn. Keep your business thriving with small business ideas during a recession.

Only 50% of small businesses will last five years. Small businesses must overcome numerous hurdles between managing employees, attracting customers, and generating revenue. During a recession, when people cut back on spending, small businesses have to work harder to drive sales and keep afloat. A recession has far-reaching effects that present numerous problems for small business owners, but it doesn’t have to be detrimental. There are things businesses can do to thrive when times are tough.

Keep reading to learn small business ideas to help navigate a recession.

Key Takeaways

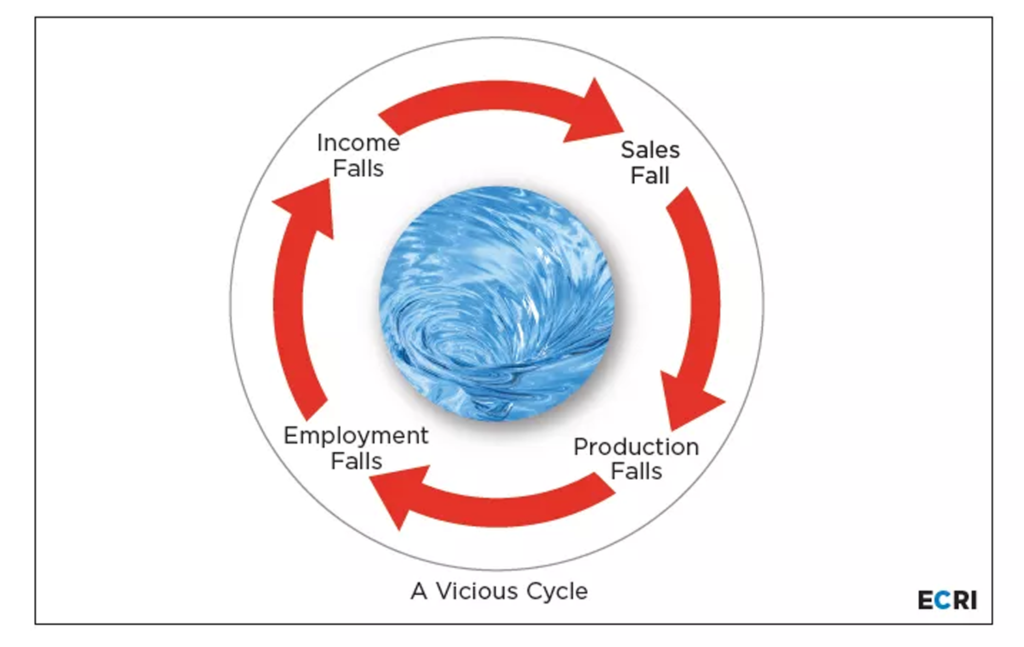

- A recession is an economic downturn that results in a decline in income, output, and employment.

- Its far-reaching effects can impact production, employment, customer attraction and retention.

- You can outlast a recession by proactively preparing for anything, reducing excessive spending, and knowing the ins and outs of your business.

What Exactly Is a Recession, and How Does it Impact Your Business?

A recession is when the economy experiences a downturn, resulting in a decline in income, output, and employment. It’s natural for the economy to fluctuate, sometimes expanding and sometimes deflating. When the economy is doing well, people have jobs and make more money, so they spend more. Lenders make borrowing money easier and more affordable, so more people take on debt, which contributes to the growth of the nation’s economy.

However, the more debt people take on, the higher the cost of assets grows. Eventually, it becomes difficult to maintain, and spending declines. Income drops, and over time, the market suffers, and companies can’t afford to pay their employees, leading to layoffs and a rise in unemployment rates. This hit to the economy results in a recession.

A recession is especially hard on small businesses because these companies don’t have the financial cushion to withstand long bouts of low revenue. The typical domino effect of a recession on small businesses is as follows:

- Customers aren’t making the income they were before, so they cannot shop or make payments on their purchases.

- These delayed payments impact a business’s ability to continue production, as they aren’t generating the revenue expected to proceed as usual.

- With less production and a decline in revenue, businesses can’t afford to purchase supplies necessary for production, let alone pay the employees who keep the business running.

A recession certainly can throw a wrench in productivity, but it isn’t impossible to overcome this kind of economic downturn. By observing the signs of a recession and thinking of innovative solutions to pre-empt the problems a recession can cause, small businesses can overcome (and even thrive during) the difficult times.

The following video explains how your company can make money during a recession:

3 Small Business Ideas During a Recession

With a proactive approach to navigating the ups and downs of our nation’s economy, a small business can fare well even in difficult times. Creative solutions can help you increase advertising revenue, grow page count, and grow distribution, all while lowering the cost of doing business. Overcome economic hardship with these three small business ideas during a recession.

1. Prepare for Anything

If you take an offensive approach to your business plan, you’ll be in a better position when the unexpected occurs (which it inevitably will). Include the following in your strategic business plans:

- Past profits: Assessing your profit history can reveal how much you made in certain months and provides a yearly comparison. Consider former recessions and the impact they had on businesses in your industry. All of this information helps you make predictions. These forecasts can help you put processes in place to ensure a positive outcome for future revenue generation.

- Contingency plans: In today’s ever-changing market, anything could happen. Develop a series of contingency plans that address specific scenarios. If any of those circumstances come to pass, you have the plan to help mitigate their impact on your business. Plans might include what to do in the event of major layoffs or how to handle the sudden inaccessibility of supplies.

- Financial safety net: If a recession does occur, your business will likely experience a decline in revenue. Prepare for this possibility by building up a financial safety net. Create a savings account solely to bail you out of a tough financial hardship. This money can mean the difference between coasting through rough waters and closing your business because you can’t afford to function.

Planning ahead can soften the blow of an unfortunate economic situation.

2. Trim the Fat

While every company has mandatory business expenses that are impossible to overlook (building space, employee payroll, supplies to create the products or services you sell), excessive spending is troublesome for small businesses, especially when a recession hits. Assess your company’s spending and identify ways you can scale back your spending and better manage your monthly cash flow.

Memberships, external training, company meals, and retreats are all costs that can add up over time. Without them, your business would still function. Take a close look at the expenses you consider mandatory and explore ways to bring those costs down. For instance, if you provide insurance for your employees, make sure you’ve chosen the most economical option for your business. If you’re purchasing specific items regularly, ask if there’s a bulk order discount.

Trim the fat and put your company in a better financial position if the economy does take a downturn.

3. Know the Ins and Outs of Your Business

When you know your business’s ins and outs, you can make informed decisions quickly and effectively. Be able to identify whether you’re a sole proprietor or an LLC. Understand which of your offerings generate the most profits and be ready to eliminate low-performing products and services. Know how much you spend when it comes to running your business. Realize which employees are top performers for your business and which ones aren’t pulling their weight.

All of these things can come into play when you have to make important decisions that affect your company’s financial future and help you realize your long-term business vision. In the face of a recession, you may need to change direction. Being armed with information can help you navigate these situations smoothly.

Create an Effective Strategy for Long-Term Success

BOOM Communications helps newspaper and magazine printing services generate more revenue through strategic marketing and advertising solutions.

Contact BOOM Communications today to learn how we can help you create effective business strategies that prepare you for long-term success.