Owning your own business has its pros and cons. On the plus side, you’re your own boss and you can work when and how you want. On the flip side, you’re responsible for paying a variety of small business taxes.

That said, there are several things you can do to minimize your business’ tax load. While you should always consult with your tax advisor or CPA before engaging in any of the following activities, here are ten ways you can enjoy tax saving for your small business.

Key Takeaways

- To reduce your tax burden, increase your business expenses and deductions

- You can reduce your taxable business income by employing family members, contributing to a retirement plan, and opening an HSA

- Lower your taxable income by deducting travel and vehicle expenses, expensing fixed assets, and taking the home office deduction

- If your business lost money in previous years, you can carry over those losses to lower your current taxes

Keys to Tax Savings for Small Business

The key to paying less tax is for your business to have less taxable income. That’s typically accomplished by realizing expenses and deductions that reduce your taxable bottom line.

1. Contribute to a Retirement Plan

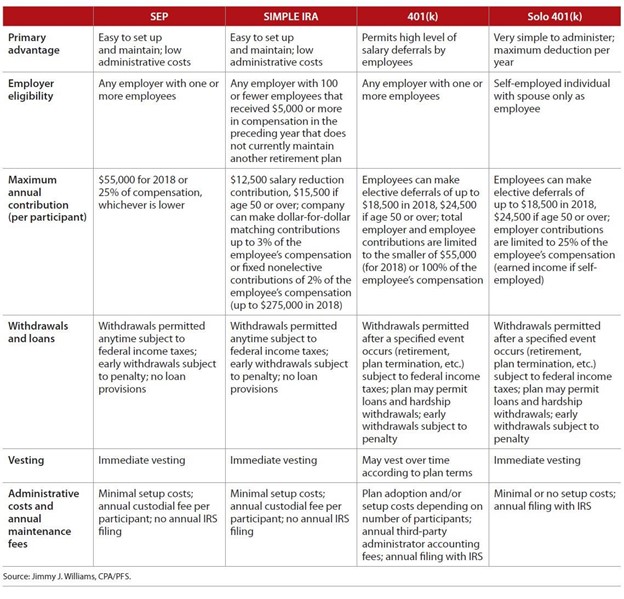

You can take some of your business profit and use it to establish or contribute to a retirement plan. The IRS lets you contribute to several different types of plans, including solo 401(k), SIMPLE IRA, and SEP IRA plans. Know that some of the rules regarding retirement plans are complex, so it’s worth talking to a tax advisor about this strategy.

SOURCE: JournalOfAccountancy.com

2. Open a Health Savings Account

Another popular way to reduce your small business taxes is to put aside funds for your personal healthcare needs via a Health Savings Account (HSA). HSA contributions are pre-tax, and withdrawals for qualified medical expenses are tax-free.

3. Hire Your Family Members

The IRS enables your business, under specified conditions, to hire your spouse and children. The salaries you pay to members of your family are counted as business expenses, lowering your taxable income. In addition, if you run a sole proprietorship or partnership, you can hire family members under the age of 21 and not have to pay FUTA taxes. If you hire a family member aged 18 or less, you don’t have to pay FICA, SUTA, or Medicare taxes, either.

4. Deduct Your Travel Expenses

If you travel a lot – or a little – for your business, you can deduct all applicable travel expenses. Business travel is fully deductible, so try to combine personal travel with justifiable business trips to the same location.

5. Deduct Your Vehicle Expenses

If you use a car or truck in the course of your business, you can deduct expenses for that vehicle. You can deduct actual fuel, insurance, and repair costs, or just use the IRS’s standard mileage deduction, which for 2021 is 56 cents per mile. (Here’s a good comparison of the different methods available.)

SOURCE: StrideHealth.com

6. Write Off Fixed Assets

While it’s common to depreciate a fixed asset a little each year over the course of its useful life, you can also use the Section 179 deduction to write off the entire asset purchase during its first year. Accelerating that expense reduces your taxable income today, even though you lose the yearly depreciation deduction going forward. Not all fixed assets are eligible for Section 179 treatment and there is a limit on how much you can deduct each year ($1 million), so you’ll probably want to consult your tax advisor on this one.

7. Take a Home Office Deduction

If you’re like a lot of small business owners, you run a lot of your business from your home – which means you can probably take a home office deduction. You can opt to tally the actual expenses associated with your home office, including a portion of your mortgage and utilities, or you can take the standard IRS deduction of $5 per square foot per year, up to a 300 square foot maximum.

The following video shows you how to maximize your home office deduction.

8. Take the Qualified Business Income Deduction

Here’s another deduction with which you might not be familiar. The Qualified Business Income (QBI) deduction can reduce your taxable income by up to 20%. The QBI does not apply to C corps but can be applied to S corps, sole proprietorships, and partnerships. This is another you should talk to your tax advisor about.

9. Make Charitable Contributions

Contributing to your favorite charity can help reduce your business’ taxable income. Your business can donate cash or, even better, an appreciated asset such as stocks or bonds. When you make a charitable stock donation, you avoid paying the capital gains tax on that stock, while still deducting the stock’s full fair market value.

You can also donate old business equipment to any 501(c)3 nonprofit organization. As you get to the end of the year, look around your office, and if you see any business equipment you’re no longer using, donate it!

10. Carry Over Business Losses

Did you know that the losses your business incurs in a prior year can be carried over to deduct in future time periods? This is an interesting tax strategy, especially if your business operated at a loss for one or more years. You can lower your current tax bill by taking a net operating loss (NOL) deduction from prior tax years. This one can also get a little complicated, but your tax advisor can guide you through it.

One Final Tip: Partner with a Good Accountant

The best tax-saving tip of all is to hire a good accountant. An accountant who has experience with your business will know all the ins and outs about what you can and can’t deduct or expense. Your accountant will keep you out of trouble and help you find all the otherwise-hidden deductions available to you. You’ll get a lot more help than if you try to do it yourself, even with the use of tax prep software.

Let the Boom Communications Group Help You Plan Your Business Strategy

The Boom Communications Group has helped more than a thousand small businesses with their advertising, marketing, and printing needs. We offer consulting and strategy services that can help you identify and adapt to your customers’ needs and ignite your business growth. Contact us to learn more about how we can work together to grow your business.

Contact Boom Communications today to ignite your business growth!