While many factors contribute to your business’s success, in the end, success depends on how well your business performs financially. Knowing how to manage your cash flow will ensure you get more money into your business than you are spending. Then, your business can grow instead of stagnating or— even worse— go bankrupt.

We explore five cash flow management strategies that will help your business gain greater financial security.

Key Takeaways:

- Cash flow is the movement of finances in and out of your business.

- A positive cash flow occurs when more money comes in than goes out.

- You can improve your cash flow by carefully monitoring your transactions and adhering to a budget.

What is Cash Flow?

Your cash flow is the money coming in and out of your business. This usually occurs through three primary areas – operations, investing, and financing. Cash flow is different from profit or revenue as those two terms refer only to assets coming into the business, whereas cash flow tracks both directions of financial movement.

Here are a few examples of cash inflow and outflow.

Cash Inflow:

- Revenue from sales

- Income from interest

- Royalties

- Licensing agreements

Cash Outflow:

- Bills

- Investments

- Production costs

- Payroll

When you have more cash inflow than outflow, you have a positive cash flow – which is your goal when building a healthy business.

Common Cash Flow Challenges

Cash flow is one of the biggest challenges that businesses face. One report showed that 61% of small businesses struggled with cash flow. As a result, 32% couldn’t pay their vendors, creditors, and employees.

Here are a few common challenges that businesses face with cash flow that might prevent their growth or cause financial hardship:

- Operating activities aren’t generating enough income

- There are outstanding accounts receivable

- There is an inventory overstock

- A business relies too heavily on borrowing

- Changes in consumer demand

- Inaccurate budgeting or bookkeeping

- A business lacks cash reserves

5 Ways to Improve How You Manage Cash Flow

We look at how to manage cash in business using five cash flow strategies that help you overcome the above-listed challenges.

How Businesses Manage Money – Cashflow Explained

1. Adhere to a Budget

Creating a budget helps you build a spending plan that results in positive cash flow. One study showed that 82% of failed businesses occur because of cash flow issues. That is because a successful business is more than just a large customer base. You also need to balance expenses with your income, which starts with a budget.

You should base your budget on previous costs and variable expenses. However, you should also forecast your revenue and expense changes in the next year, like inflation, business growth, or upcoming operations costs. In addition to budgeting for known costs, always set aside finances in a contingency fund for unexpected expenses.

If your business consistently oversteps the budget or a significant change occurs, you should adjust your budget to take the difference into account rather than continuing to overspend.

2. Keep Thorough Records

While your budget projects an ideal cash flow, your records will show your current cash flow. Maintaining thorough records keeps your business accountable to your budget. It also helps you spot areas that are draining funds or whether you are not driving enough revenue for growth.

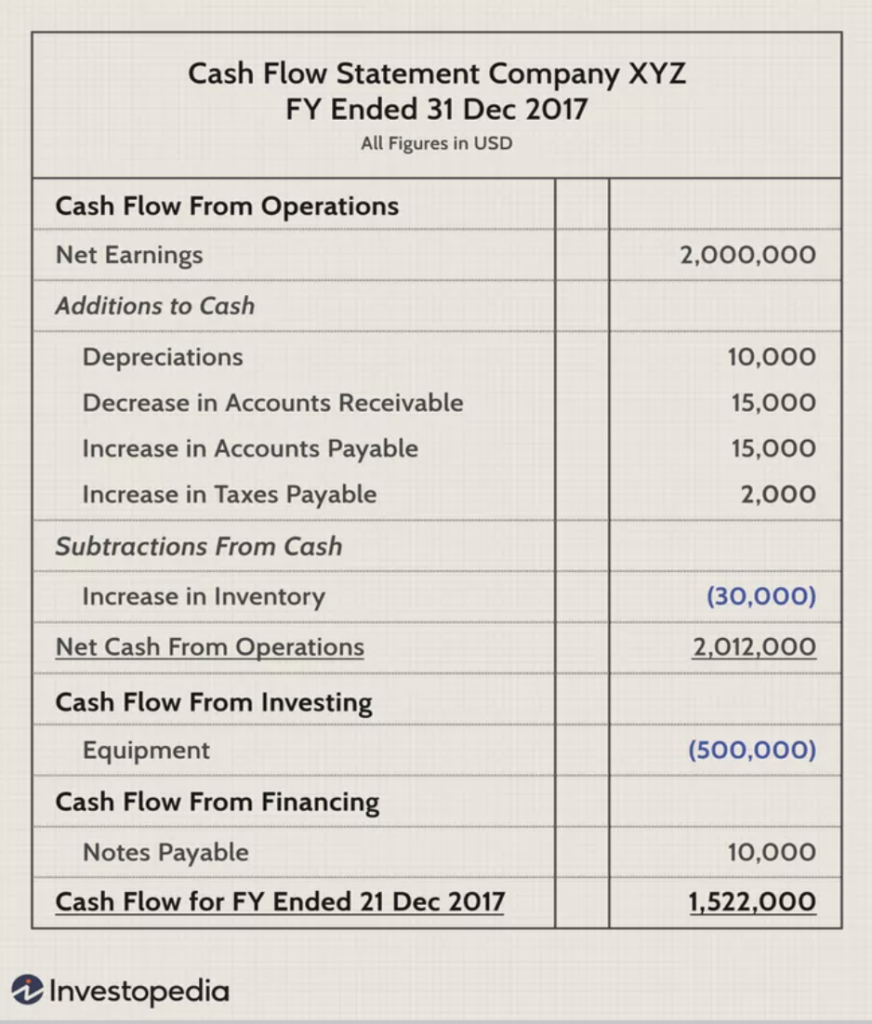

Your cash flow statement will help you track and manage your cash flow. Below is an example of a cash flow statement.

3. Pay Expenses Strategically

Expenses are unavoidable. However, the date when you pay them is often flexible. Therefore, you can use timing to your advantage by spreading out payments to take care of the most urgent expenses first.

Staggering your costs instead of paying them in one lump sum will help balance out the inflow and outflow of cash each month. For example, you can align known costs with predicted accounts receivable instead of paying for expenses before the money flows back into the business, resulting in a negative cash flow for part of the month.

Another cost you should stagger is your inventory costs. While you might feel optimistic that you will sell a large amount of inventory, you might end up in a financial hole because of overstock. Instead, spread out your restocking to ensure you have enough to cover transactions while also balancing the operating costs of the merchandise. Inventory automation can help you track and manage purchase trends.

4. Collect Payments Quickly

One way for your cash flow to quickly turn from positive to negative is when you don’t receive accounts receivables on time. Here are several ways to encourage prompt invoice payments and get the money into your accounts faster:

- Promptly send out invoices to your customers

- Ask for a deposit before you complete a service or send a product

- Send out smaller, regular invoices instead of one large bill at the end of the service period

- Set up faster systems that simplify payments so that funds are available sooner

- Offer discounts or other incentives for customers who pay bills quickly

- Automate your payment system for better tracking

5. Analyze Your Cash Flow

Regularly analyze your cash flow by examining your budget, records, and processes. If you have a data management system in place, it can collect information about your spending and help you identify potential weaknesses in your cash flow.

Some examples of cash flow analysis include negotiating with suppliers for the best price, limiting your reliance on credit and loans without a plan in place for repaying the loans, and reducing your spending in areas that aren’t vital to your organization.

The best approach to cash flow is a proactive approach that detects issues before they occur. Then, if you see a potential financial challenge in the future, you can start planning today. For example, you can raise the prices of products in preparation for inflation to ensure you can afford any higher manufacturing or operating costs that might occur.

Take Charge of Your Cash Flow

Do you feel like you are drowning in expenses with minimal cash inflow?

Then you might need to redesign your sales and marketing strategy to ensure you have a positive cash flow – which will help your business thrive even in today’s economy.

Contact us for more information about our business growth, sales, and strategy services.