Thinking of Selling Your Business? Here’s What You Need to Know

Owning a business takes time, resources, and knowledge. Unsurprisingly, selling your business is no different.

With inflation, rising costs, and supply chain disruption, business sales are on the rise. In 2021, 8,647 business owners sold their companies, totaling 1,000 more than the previous year. Maybe you’re unable to increase advertising revenue, grow page count, or grow distribution. Perhaps you’re finding it difficult to make ends meet, even after lowering the cost of doing business. Or maybe you’ve been highly successful, and you’re simply ready to move on to other ventures. Whatever the reason, there are many details to keep in mind when selling your business.

Keep reading to learn what you need to know to set yourself up for success when selling your business.

Key Takeaways

- When selling your business, identify your motivators to prepare for the financial and emotional outcomes of the sale.

- Your business is worth more than the revenue it generates. Know your valuation so you can maximize your asking price.

- Prepare organized financial records, an operations manual, and a history of the business to persuade potential buyers.

- Boost your sales and overall performance before you put your business on the market to attract prospective buyers.

- Hire a professional broker to help guide you through the sales process.

5 Things to Know When Selling Your Business

Selling your newspaper printing or magazine printing business isn’t like selling a piece of furniture. You can’t just put a price tag on it and take the best bid that comes along. Selling your business is a complex process that impacts your future. Ideally, you’ll begin planning this process two years in advance to allow time to adequately prepare so you can maximize your profits. The following video provides the ideal parameters for when to sell your business:

When the time is right, here are five things you need to know when selling your busines

1. Understand Why You’re Selling

As you begin to attract potential buyers, the first question they’ll likely ask is why you’re selling your business. Think now about the motivators for this large financial and emotional decision. It could be because you:

- Need more capital

- Are ready to retire

- Want to diversify assets

- Identify a declining industry

- Experience partnership dissolution

Whatever the reason, it’s important to recognize that this decision will have a big impact on your future. Financially, it can provide you with significant assets that could potentially be life-changing. Emotionally, you’ll lose your ties to the business and the relationships you’ve developed there. For potential buyers and for yourself, it’s important to assess your reasons for selling your business and whether the rewards outweigh your concerns. Knowing these reasons is important for your own peace of mind.

2. Know Your Business’s Valuation

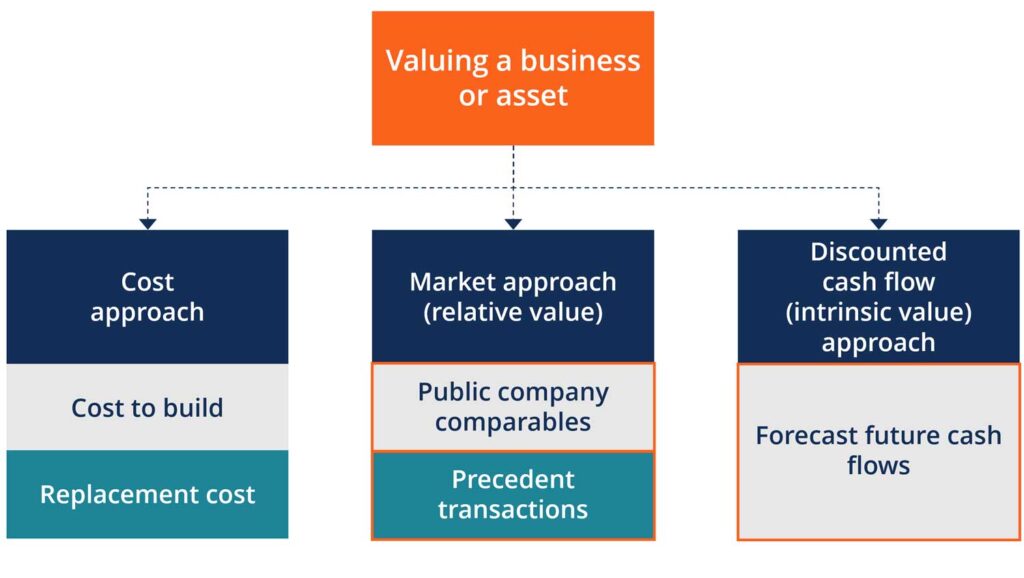

To know how much to ask for your business, you first need to know its valuation. What is it worth? Consider inventory, debts, sales, and all other assets to see the true financial value of your company. Today’s business owners have around 70%-80% of their net worth tied to their company. For this reason, you want to ensure your sale promotes your company’s maximum value, so you have some financial security post-sale.

To determine valuation, it’s best to hire a third-party accountant who is an Accredited in Business Valuation (ABV) professional. This is a certification earned by individuals specializing in calculating a business’s value. Understanding how much your business is truly worth will help guide your asking price.

3. Organize Business Records

Prospective buyers are essentially looking for two things when purchasing a business:

- Profitability: can the business make money?

- Long-term viability: is the business sustainable?

For this reason, you need to ensure your financial records are in order, as these will play a big role in the success of your sale. Meet with your accountant to review your tax returns (from the past three to five years) and financial statements. Build a list of everything included with the sale, like:

- Inventory

- Equipment

- Intangible assets

- Intellectual property

Additionally, you should create an operations manual to help guide new owners through the ins and outs of running your business. Provide contacts for suppliers, passwords for memberships, and login information for all digital accounts. You should also present a clear history of the business, using transparency to share the pros and cons so buyers can make an informed purchase decision. Suggestions and unique ideas to grow small newspaper revenue can help buyers envision their long-term future with the company and see the benefit of investing in such a purchase.

4. Attract with High Performance

As you prepare to leave your business, you may feel that sales figures are no longer your concern. The truth is, buyers don’t just want a company that’s surviving. They want a company that’s thriving. To ensure a business is viable, potential buyers look at sales records and gross profits that reflect a continual sales growth year-over-year. Now is the time to boost your overall performance so buyers will see your company’s potential.

Evaluate your ESG ratings. Attract prospective buyers with solid income streams and several revenue sources. Boost sales and diversify your customer base to maximize profits and increase valuation. Consider your current contracts and think of ways you can strengthen those relationships. A buyer may balk if they fear your current customers will leave when you do. Ensure you’ve nurtured those customers and done all you can to create a smooth transfer to new ownership.

5. Hire a Professional Broker

A third-party broker can help you find qualified buyers and ensure you get the greatest value for your business. They know the right questions to ask potential buyers, including:

- Do they have the capital?

- Have they gotten funding?

- Do they have the experience needed to run the business?

- Are they prepared to purchase within the necessary timeframe?

These details can be important in selecting the right buyer for the best possible outcome. In addition to pre-qualifying the right buyer, business brokers can also help calculate your valuation and guide your negotiation process to a successful close. Throughout the sales process, they can help you:

- List your property: brokers can share your listing on business directories to ensure you reach the right audience.

- Secure funding for buyers: they have access to a pool of private lenders and financial institutions.

- Manage due diligence: brokers can help sellers avoid common pitfalls that can cause deals to fall through.

By entrusting this task to a professional, you can be sure to follow all the right procedures to experience a smooth sales process, successful transaction, and a positive outcome for all parties involved.

Attract Buyers with Higher Performance

BOOM Communications delivers marketing and advertising strategies that help increase visibility, earn conversions, and generate more sales.

Interested in selling your business? Contact BOOM Communications today to boost sales and attract potential buyers.